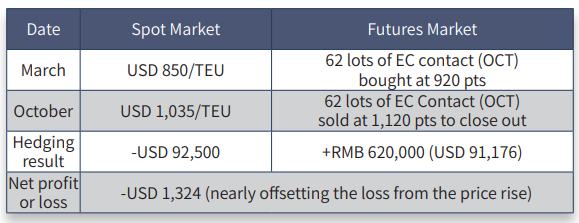

B.Long hedge by shippers As capacity consumers, shippers will face major uncertainties to keeping import and export costs under control in the case of a rise in freight rates. To manage the transport costs and hedge against a sharp rise in freight rate, a shipper may take a long hedge position in the EC contract, which will reduce its exposure to price fluctuations, i.e., it should first buy futures of a similar quantity to that to be bought in the spot market, and then, at time of the actual purchase of capacities, sell the futures to close out its position. Here is an example: Suppose in March 2023, the containerized freight index (Europe service) is 917 points, and the spot freight rate is about USD 850/ TEU. A domestic shipper signs a CIF trade agreement for exporting 500 TEU of Christmas merchandise from Shanghai in October. The shipper is worried that possible freight rate rises will push up its export cost. To avoid this price risk, the shipper decides to take a long hedge position in EC contracts on INE. This hedge and the resulting profits and losses are illustrated below: The capacity to be bought by the shipper: 500 TEU × USD 850/TEU × 6.8 (RMB/ USD) = RMB 2,890,000 Quantity of EC contracts to be bought in March: RMB 2,890,000 ÷ 920 (index pts of EC contract (OCT)) ÷ 50 (contract multiplier) = 62 lots

While the adverse price movement in the spot market incurs an additional cost to the shipper, a profit in the futures market has nearly offset that loss.

声明:本资料仅用于投资者教育,不构成任何投资建议。我们力求本资料信息准确可靠,但对这些信息的准确性、完整性或及时性不作保证,亦不对因使用该等信息而引发的损失承担任何责任,投资者不应以该等信息取代其独立判断或仅根据该等信息做出决策。基金有风险,投资须谨慎。