An enterprise processing crude oil signed a purchase contract for 10,000 barrels

of crude oil, whereby the crude oil would be delivered in a month at the then

prevailing price. The current spot price of crude oil is 392.0 Yuan/barrel. Afraid

of a further increase in crude oil price, this enterprise has the demand to enter

into a long hedge. To do so, it may choose a futures or options hedging strategy.

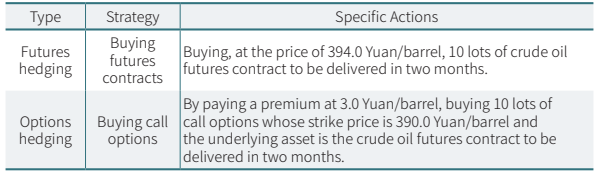

Table 3 Specific Actions Involved in Futures and Options Hedging Strategies

1.If the spot and futures prices rise to 410.0 Yuan/barrel and 412.0 Yuan/barrel

respectively a month later:

Futures hedging strategy:

Profit or loss from the spot positions: 392.0 - 410.0 = - 18.0 Yuan/barrel

Profit or loss from the futures positions: 412.0 - 394.0 = 18.0 Yuan/barrel

Total profit or loss: 18.0 - 18.0 = 0 Yuan/barrel

Actual buying price: 392.0 + 0 = 392.0 Yuan/barrel

Options hedging strategy:

Profit or loss from the spot positions: 392.0 - 410.0 = - 18.0 Yuan/barrel

Profit or loss from the options positions (upon exercise of the options): 412.0 -

390.0 - 3.0 = 19.0 Yuan/barrel

Total profit or loss: 19.0 - 18.0 = 1.0 Yuan/barrel

Actual buying price: 392.0 - 1.0 = 391.0 Yuan/barrel

2.If the spot and futures prices drop to 380.0 Yuan/barrel and 382.0 Yuan/barrel

respectively in a month:

Futures hedging strategy:

Profit or loss from the spot positions: 392.0 – 380.0 = 12.0 Yuan/barrel

Profit or loss from the futures positions: 382.0 - 394.0 = -12.0 Yuan/barrel

Total profit or loss: 12.0 - 12.0 = 0 Yuan/barrel

Actual buying price: 392.0 + 0 = 392.0 Yuan/barrel

Options hedging strategy:

Profit or loss from the spot positions: 392.0 – 380.0 = 12.0 Yuan/barrel

Profit or loss from the options positions (upon abandonment of the options):

premium loss = -3.0 Yuan/barrel

Total profit or loss: 12.0 - 3.0 = 9.0 Yuan/barrel

Actual buying price: 392.0 - 9.0 = 383.0 Yuan/barrel

声明:本资料仅用于投资者教育,不构成任何投资建议。我们力求本资料信息准确可靠,但对这些信息的准确性、完整性或及时性不作保证,亦不对因使用该等信息而引发的损失承担任何责任,投资者不应以该等信息取代其独立判断或仅根据该等信息做出决策。基金有风险,投资须谨慎。